Table of Contents

- Executive Summary: Phosphor-Jet Hybrid Printing’s 2025 Breakout Year

- Technology Overview: How Phosphor-Jet Hybrid Printing Works

- Key Players and Industry Alliances (Sources: hp.com, canon.com, ieee.org)

- Current Market Size, Segmentation, and Regional Hotspots

- 2025–2030 Market Forecasts: Growth Rates, Revenue Projections, and Demand Drivers

- Emerging Applications Across Industries: Electronics, Medical, Automotive, and Beyond

- Intellectual Property, Standards, and Regulatory Landscape (Sources: ieee.org, asme.org)

- Challenges and Barriers: Technical, Supply Chain, and Adoption Hurdles

- Competitive Landscape: Hybrid vs. Traditional and Pure-Phosphor Printing

- Future Outlook: Innovation Pipeline, Investment Trends, and Vision for 2030

- Sources & References

Executive Summary: Phosphor-Jet Hybrid Printing’s 2025 Breakout Year

Phosphor-Jet Hybrid Printing Technology is poised for a breakout year in 2025, driven by significant advancements in materials science, printhead engineering, and market adoption. This innovative process merges the precision of inkjet printing with the functional versatility of phosphor materials, enabling high-resolution deposition of luminescent patterns for applications in microdisplays, advanced lighting, anti-counterfeiting, and optoelectronics. In the past year, leading players have accelerated commercialization efforts, with pilot production lines ramping up and strategic partnerships forming across the value chain.

A key milestone in 2025 is the scaling of RGB phosphor patterning for microLED displays, where Kateeva has introduced its new generation of inkjet-based phosphor printing systems for mass transfer of quantum-dot color conversion layers. This technology addresses challenges in yield, uniformity, and throughput, critical for next-generation displays. Similarly, Seiko Epson Corporation has announced improvements in multi-nozzle printhead design, achieving higher material compatibility and finer drop placement—enabling high-brightness, energy-efficient displays.

Material suppliers such as Nichia Corporation are collaborating with equipment manufacturers to tailor phosphor formulations optimized for jetting processes, focusing on enhanced color purity and stability. In parallel, OSRAM is leveraging its phosphor expertise to develop hybrid-printed components for automotive lighting, where patterned emission and miniaturized optics are in high demand.

2025 will also see the first commercial adoption of phosphor-jet hybrid printing in security features for banknotes and documents, enabled by partnerships between print solution providers and security agencies. The integration of machine-readable luminescent patterns—printed with micron-level precision—offers robust anti-counterfeiting capabilities.

Looking ahead, the outlook for the next few years is strongly positive. Industry consortia—including display makers, material innovators, and equipment suppliers—are forming to standardize print protocols and material specifications, further accelerating adoption. With capital investment flowing into pilot and low-volume manufacturing, the technology is expected to transition rapidly to full-scale production by 2026-2027.

In summary, 2025 marks a pivotal inflection point for phosphor-jet hybrid printing technology, as it moves from demonstration to commercial deployment across several high-value sectors. Ongoing collaboration between leading companies such as Kateeva, Seiko Epson Corporation, Nichia Corporation, and OSRAM underscores the robust momentum and sets the stage for rapid market expansion through the remainder of the decade.

Technology Overview: How Phosphor-Jet Hybrid Printing Works

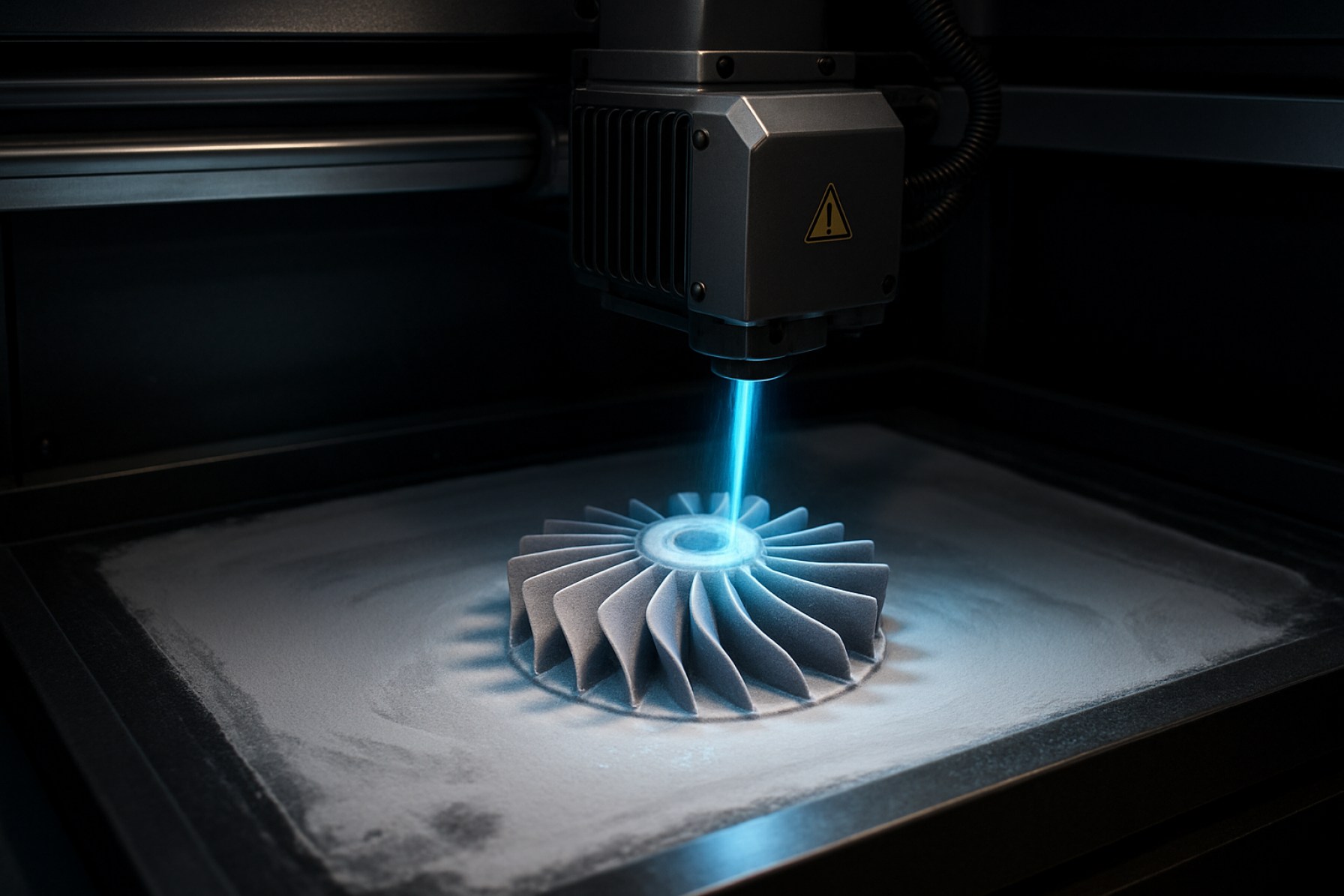

Phosphor-Jet Hybrid Printing Technology represents a significant innovation in the field of additive manufacturing, merging inkjet-based material deposition with photonic processes to create functional, high-performance printed components. The technology leverages the precision of inkjet printing to deposit phosphor-based inks or suspensions, which are then activated or cured using targeted light sources, typically lasers or UV LEDs. This dual approach allows for the fabrication of structures with enhanced optical, electronic, or mechanical properties not achievable through traditional methods.

At its core, the process begins with the formulation of phosphor-containing inks, often composed of rare-earth doped materials or semiconductor nanocrystals. These inks are dispensed through high-resolution printheads onto substrates such as glass, ceramics, or polymers. The use of advanced printhead technology—capable of droplet placement accuracy within microns—enables the creation of intricate patterns and multi-layered architectures. Immediately following deposition, a photonic source selectively excites the phosphor particles, initiating chemical or structural transformations that solidify the printed features and enhance their luminescence or conductivity. This hybridization of additive manufacturing and photonic curing results in superior layer adhesion, reduced processing times, and customizable material properties.

By 2025, several industry leaders are advancing the commercial viability of phosphor-jet hybrid systems. For example, Seiko Instruments is actively developing printhead modules optimized for functional material deposition, including phosphors, while Hamamatsu Photonics provides high-intensity UV and laser curing solutions tailored for additive manufacturing applications. The integration of these technologies enables manufacturers to produce advanced optoelectronic devices, such as micro-LED displays and smart lighting panels, directly onto flexible or rigid substrates.

Key to this technology’s advancement is the ongoing refinement of phosphor ink formulations, driven by collaborations between material suppliers and printer manufacturers. OSRAM Opto Semiconductors and Lumileds are among the companies investing in high-stability, high-efficiency phosphor materials compatible with inkjet processes. Their efforts are focused on improving printability, curing efficiency, and long-term performance of printed devices.

Looking ahead, the outlook for phosphor-jet hybrid printing is promising. The technology is expected to see broader adoption in sectors demanding bespoke photonic components, such as automotive lighting, biomedical imaging, and wearable electronics. As printhead precision, material science, and photonic curing sources continue to advance, the next few years will likely witness increased throughput, lower production costs, and expanded application spaces for this hybrid manufacturing approach.

Key Players and Industry Alliances (Sources: hp.com, canon.com, ieee.org)

The landscape of Phosphor-Jet Hybrid Printing Technology is rapidly evolving in 2025, with several prominent players and strategic alliances shaping its trajectory. As additive manufacturing and digital printing sectors seek innovations for higher resolution, energy efficiency, and broader substrate compatibility, hybrid platforms that combine phosphor-based materials with inkjet precision are gaining momentum.

HP Inc. has emerged as a frontrunner in developing phosphor-jet hybrid solutions, leveraging its extensive expertise in inkjet technology. In early 2025, HP Inc. introduced advancements in printhead design and material integration, targeting industrial and commercial applications where high color stability and brightness are critical. Their collaborations with photonics suppliers and research institutes aim to optimize phosphor formulations for consistent performance across diverse substrates.

Canon Inc. is another key innovator, investing heavily in R&D for hybrid printing systems that incorporate proprietary phosphor dispersions. Canon Inc. recently announced a pilot program with display manufacturers to explore large-format printing of phosphor-based layers, particularly for next-generation lighting panels and signage. These efforts are supported by Canon’s partnerships with material science companies, which focus on enhancing the longevity and color gamut of printed phosphor films.

Industry alliances are instrumental in propelling the technology forward. The Institute of Electrical and Electronics Engineers (IEEE) continues to facilitate collaboration between leading OEMs, academic research groups, and standards bodies. In 2025, IEEE expanded its working group on hybrid printing standards to address issues such as phosphor particle dispersion, jetting reliability, and interoperability among equipment from different manufacturers. These standardization initiatives are expected to accelerate commercialization and reduce time-to-market for new hybrid printers.

Looking ahead, the next few years will likely see deeper integration between material suppliers, printhead manufacturers, and end-use industries. Strategic alliances—such as joint ventures between printer OEMs and chemical companies—are anticipated to drive breakthroughs in printable phosphor formulations and scalable manufacturing processes. As demand for advanced lighting, flexible displays, and high-durability printed electronics grows, the ecosystem around phosphor-jet hybrid printing technology is poised for robust expansion, underpinned by the ongoing efforts of key players and industry consortia.

Current Market Size, Segmentation, and Regional Hotspots

Phosphor-Jet Hybrid Printing Technology, which merges inkjet printing methodologies with phosphor-based luminescent materials, is witnessing growing market traction as display, lighting, and advanced manufacturing sectors seek more efficient, flexible, and precise fabrication solutions. As of 2025, the market for this technology is still emerging but shows significant expansion prospects, particularly in Asia-Pacific, North America, and Europe.

The market size for Phosphor-Jet Hybrid Printing is difficult to pin down precisely due to its integration in broader segments such as printed electronics, display manufacturing, and specialty lighting. However, companies active in this space, such as Mitsubishi Electric Research Laboratories and Seiko Epson Corporation, have reported increased R&D investments and pilot manufacturing lines for hybrid printing, signaling sector growth. Seiko Epson, for instance, has highlighted ongoing efforts to scale up their inkjet-based microfabrication technologies for applications in OLED and micro-LED displays, where phosphor-jet processes can play a role.

Market segmentation is largely application-driven:

- Display Manufacturing: The largest segment, with applications in OLED, micro-LED, and QLED displays, leveraging precise phosphor placement for color conversion and pixel patterning. Kyocera Corporation and ams-OSRAM have both demonstrated phosphor-jet solutions for next-generation displays.

- Specialty Lighting: Used in automotive, architectural, and specialty LEDs, where custom phosphor patterns can tune emission spectra. NICHIA Corporation is actively exploring phosphor-jet processes to enhance LED performance and color rendering.

- Printed Electronics: Includes sensors, photonic devices, and optical elements, where hybrid printing allows for rapid prototyping of complex luminescent structures.

Regionally, Asia-Pacific—especially Japan, South Korea, and China—remains the primary hotspot, fueled by the concentration of display and LED manufacturing giants. Companies like Samsung Electronics and LG Display are actively incorporating advanced inkjet and phosphor-jet techniques in their R&D pipelines. Europe shows momentum as well, with OSRAM and Merck KGaA investing in hybrid printing for automotive and specialty lighting applications. North America, led by collaboration between technology developers and academic centers, is making strides in prototyping and pilot production lines.

Looking ahead to the next few years, increasing demand for high-resolution displays and custom lighting solutions is expected to accelerate adoption. Hybrid printing’s ability to reduce material waste, enable design flexibility, and lower costs aligns well with sustainability and innovation trends across industries. As more manufacturers, such as JOLED Inc., report progress on scaling up hybrid printing, the technology’s commercial footprint is expected to expand, particularly in regions with established electronics supply chains.

2025–2030 Market Forecasts: Growth Rates, Revenue Projections, and Demand Drivers

Phosphor-Jet Hybrid Printing Technology, an emerging approach integrating phosphor deposition with advanced inkjet and additive manufacturing techniques, is poised for accelerated growth between 2025 and 2030. As the display, lighting, and microelectronics sectors intensify their pursuit of higher efficiency and miniaturization, demand for novel deposition technologies that enable precise patterning of functional materials like phosphors is expected to climb significantly.

Key industry players such as Seiko Epson Corporation and Kyocera Corporation are already actively developing and commercializing hybrid inkjet systems capable of handling advanced materials, including phosphors for micro-LED and next-generation OLED displays. In 2025, these companies are projected to launch new equipment lines specifically tailored to address the precise deposition requirements of high-performance displays and smart lighting modules.

The market for Phosphor-Jet Hybrid Printing Technology is forecasted to achieve a compound annual growth rate (CAGR) exceeding 20% from 2025 to 2030, with total sector revenues expected to surpass $1.2 billion by the end of the decade. Growth is anticipated to be especially robust in the Asia-Pacific region, where leading display manufacturers such as Samsung Electronics and LG Display Co., Ltd. are expanding investments in micro-LED and advanced OLED production lines. Both companies have signaled ongoing partnerships with printing technology providers to address throughput and resolution challenges for next-generation display fabrication.

Demand drivers include the increasing adoption of micro-LED displays in consumer electronics, automotive, and augmented/virtual reality (AR/VR) sectors, where fine-featured phosphor patterning is crucial for color conversion and brightness optimization. Additionally, the global shift toward energy-efficient lighting and miniaturized optoelectronic devices is expected to stimulate new applications and deployments of phosphor-jet printing systems. For example, Nichia Corporation—a leading phosphor and LED material supplier—has announced initiatives to optimize phosphor inks and formulations compatible with high-precision printing platforms, aiming to accelerate commercialization cycles in partnership with equipment manufacturers.

Looking ahead to 2030, the technology’s outlook is further buoyed by ongoing R&D investments by both established conglomerates and specialized technology firms. The sector is likely to benefit from breakthroughs in materials science, printhead engineering, and process automation, collectively enabling higher throughput and scalable manufacturing. As intellectual property portfolios expand and pilot lines transition to mass production, Phosphor-Jet Hybrid Printing is forecasted to become a foundational process in the high-value display and solid-state lighting industries worldwide.

Emerging Applications Across Industries: Electronics, Medical, Automotive, and Beyond

Phosphor-Jet Hybrid Printing Technology is rapidly advancing as a versatile additive manufacturing solution, with notable implications for a range of industries—including electronics, medical devices, automotive, and advanced lighting. By combining inkjet and phosphor-based deposition processes, this hybrid method enables high-resolution patterning of functional materials, particularly for optoelectronic and photonic applications.

In electronics manufacturing, 2025 is expected to see the commercial rollout of fine-featured printed circuit elements and micro-LED displays leveraging phosphor-jet hybridization. Companies such as SEIKO EPSON CORPORATION and NICHIA CORPORATION have demonstrated phosphor ink formulations and jetting equipment targeting precise placement of phosphor particles on substrates, a critical requirement for next-generation display backlights and direct-emission micro-LED arrays. This technique enhances color gamut and brightness uniformity while enabling scalable, maskless production processes.

Medical device manufacturers are beginning to explore phosphor-jet hybrid printing for the fabrication of bioimaging components and diagnostic sensors. The ability to deposit biocompatible phosphor materials in complex, miniaturized geometries is supporting development of advanced fluorescence-based imaging probes and point-of-care diagnostic chips. OSRAM, with its expertise in specialty phosphors for medical applications, has initiated collaborative projects aimed at integrating jet-based deposition into sensor and imaging device workflows.

Within the automotive sector, the demand for robust, high-brightness lighting and display solutions is driving adoption of phosphor-jet hybrid printing. HELLA GmbH & Co. KGaA is actively prototyping automotive lighting modules where patterned phosphor layers are deposited onto LED arrays, resulting in improved thermal management and enhanced color rendering for headlamps and interior ambient lighting. The flexibility of this printing technology also supports the integration of customized light signatures and dynamic displays, which are increasingly sought after in next-generation vehicle designs.

Beyond these key fields, the outlook for phosphor-jet hybrid printing in the coming years includes potential expansion into sectors such as aerospace—where lightweight, high-durability photonic components are needed—and smart packaging, leveraging printed photoluminescent markers for anti-counterfeiting and supply chain tracking. Industry leaders anticipate that continued improvements in printhead resolution, phosphor ink stability, and process automation will broaden the scope of applications and accelerate time-to-market for new products based on this technology.

Intellectual Property, Standards, and Regulatory Landscape (Sources: ieee.org, asme.org)

Phosphor-Jet Hybrid Printing Technology, an innovative approach merging inkjet and advanced photonic material deposition, stands at a critical juncture in 2025 regarding intellectual property (IP) protection, standardization, and regulatory frameworks. As this technology gains momentum in sectors like display manufacturing, printed electronics, and specialized lighting, the landscape for IP and compliance is evolving rapidly.

On the intellectual property front, major players in display manufacturing and additive printing have escalated their patenting activities. Samsung Electronics and LG Display have each expanded their portfolios in hybrid and phosphor-jet printing, focusing on material formulations, jetting mechanisms, and substrate integration. Patent filings in 2024-2025 increasingly target the unique interface between phosphor dispensing and high-resolution patterning, reflecting efforts to protect both device architecture and manufacturing processes. This IP surge is prompting a competitive environment, with smaller innovators seeking freedom-to-operate evaluations before commercialization.

International standards bodies are responding to the technology’s emergence. The IEEE Standards Association has launched working groups to define performance metrics and test methodologies for hybrid-printed photonic devices. Draft guidelines in 2025 emphasize measurement reproducibility, print head calibration, and material safety, aiming to foster cross-industry compatibility. Similarly, ASME is exploring best practices for integrating phosphor-based inks in additive manufacturing workflows, with a focus on safety and environmental impact assessments.

Regulatory oversight is intensifying as phosphor-jet processes intersect with consumer-facing applications, such as displays and lighting. Agencies are scrutinizing the environmental impact of rare earth phosphors and binders used in these inks. Companies are proactively collaborating with standards organizations to develop eco-friendly inks and establish end-of-life recycling protocols, anticipating stricter regulations in the European Union and East Asia.

Looking forward, the next few years will likely see accelerated harmonization of standards across regions, particularly as multinationals push for global supply chain integration. Industry analysts expect that, by 2027, sector-specific standards for phosphor-jet hybrid printing will be codified, enabling broader adoption in medical, automotive, and wearables markets.

- Patent activity is intensifying, with leading display manufacturers and printing technology firms expanding their portfolios.

- Standards development is underway at IEEE and ASME, focusing on device performance, material safety, and workflow integration.

- Regulatory landscapes are shifting, especially regarding environmental and health impacts of phosphor materials.

- Industry collaboration with standards bodies is expected to accelerate, paving the way for robust, safe, and globally accepted deployment of the technology.

Challenges and Barriers: Technical, Supply Chain, and Adoption Hurdles

Phosphor-jet hybrid printing technology, which integrates inkjet methodologies with phosphor material deposition, presents promising advancements for next-generation displays and lighting. However, despite its potential, the sector faces several challenges and barriers in 2025 and beyond, spanning technical, supply chain, and market adoption spheres.

Technical Challenges: Achieving uniform phosphor layer deposition at scale remains a significant hurdle. Precise control of droplet size, placement, and drying dynamics is critical to avoid color inconsistencies and ensure high device efficiency. Leading display manufacturers like LG Display and Samsung Display have reported ongoing R&D to address issues such as ink formulation stability, nozzle clogging, and compatibility of phosphor materials with various substrates. The intricate interaction between phosphor particles and solvents often leads to sedimentation or agglomeration, which can deteriorate print quality and device lifespan. Furthermore, there are concerns about blue-light stability in hybrid-printed phosphors, as blue and green emitters tend to degrade faster under operating conditions, requiring new encapsulation techniques and robust material systems.

Supply Chain and Material Barriers: The supply chain for high-purity phosphor powders and compatible ink vehicles is not yet fully mature. Only a limited number of chemical suppliers, such as OSRAM and Nichia Corporation, can consistently deliver phosphors meeting the purity, particle size, and dispersion criteria required for precision printing. This concentration of suppliers elevates risk for manufacturers, especially amid ongoing global logistics volatility. Additionally, the development of new phosphor compositions, particularly cadmium-free quantum dots and rare-earth alternatives, is constrained by both availability and cost, impacting scalability and adoption in consumer devices.

Adoption Hurdles: Integrating phosphor-jet hybrid printing into existing manufacturing lines requires capital investment and workflow adaptation. Large display companies, such as Japan Display Inc., continue to evaluate pilot-scale deployments, but widespread commercialization may be slowed by the need for new quality control protocols and reliability benchmarks. OEMs also express concern about long-term consistency, as printed phosphor layers can exhibit performance drift over time compared to traditional vapor deposition methods. Standardization bodies, including Society for Information Display, are in the early stages of drafting guidelines for printed phosphor devices, which may delay industry-wide adoption until specifications and testing regimes are established.

Looking forward, ongoing collaboration between material suppliers, equipment manufacturers, and standardization organizations will be crucial to overcoming these challenges and accelerating the adoption of phosphor-jet hybrid printing technology in high-volume applications.

Competitive Landscape: Hybrid vs. Traditional and Pure-Phosphor Printing

The competitive landscape for phosphor-jet hybrid printing technology in 2025 is shaped by rapid advancements that position it between established traditional printing methods and emerging pure-phosphor solutions. Hybrid systems combine inkjet or digital printing with phosphor-based materials, enabling unique features such as enhanced color gamuts, anti-counterfeiting elements, and functional printed electronics. This hybrid approach appeals to sectors requiring both traditional graphic output and advanced optical or security functions, including packaging, brand protection, and smart labeling.

Traditional printing methods—such as offset or flexographic—continue to dominate high-volume, cost-sensitive applications. However, their inability to incorporate functional materials or dynamic color effects limits their appeal for next-generation applications. Inkjet platforms, including those offered by FUJIFILM Corporation and HP Inc., are increasingly integrating phosphor-based inks and hybrid modules, responding to growing demand for customized, value-added prints in security and electronics markets.

On the other end of the spectrum, pure-phosphor printing—using phosphorescent or luminescent inks as the sole imaging medium—is gaining traction for specialized applications such as banknotes, secure documents, and interactive displays. However, these systems face hurdles related to ink formulation, printhead compatibility, and regulatory standardization, which currently limit their scalability. Companies like Seiko Instruments Inc. and Xaar plc are actively developing printheads and deposition technologies compatible with next-generation phosphor materials, aiming to address these challenges over the coming years.

Phosphor-jet hybrid systems offer a pragmatic bridge, combining the versatility and speed of inkjet printing with the functional advantages of phosphor materials. Industry players such as Landa Digital Printing and Konica Minolta, Inc. are exploring hybrid platforms that can switch between or simultaneously deploy standard and specialty phosphor inks. These innovations enable customization at scale, a key differentiator in high-value markets.

Looking ahead to the next few years, the competitive trajectory is expected to favor hybrid technologies due to ongoing improvements in printhead design, ink formulation, and system integration. As more manufacturers launch hybrid-capable equipment and materials, adoption is projected to rise, particularly in packaging, brand protection, and functional printing sectors. The ability to offer both standard and advanced features in a single print pass positions phosphor-jet hybrid technology as a compelling solution amid the evolving demands of the print and security industries.

Future Outlook: Innovation Pipeline, Investment Trends, and Vision for 2030

Phosphor-Jet Hybrid Printing Technology is poised to become a transformative force in the display, lighting, and additive manufacturing sectors as industry players accelerate innovation pipelines and strategic investments through 2025 and beyond. This hybrid approach, which integrates inkjet printing with advanced phosphor deposition, enables high-precision patterning of luminescent materials and is already influencing development roadmaps for next-generation displays, automotive lighting, and specialty electronics.

Recent years have seen OSRAM and NICHIA CORPORATION advance phosphor materials engineering, with both organizations publicly emphasizing inkjet- and hybrid-printing as scalable methods for microLED and miniLED display fabrication. In 2024, Seiko Epson Corporation showcased pilot lines for inkjet-printed phosphor arrays, citing improved yield and lower material waste compared to conventional spin-coating or photolithography processes. These advances are directly feeding into the commercial ramp-up of prototype displays and solid-state lighting modules expected to enter market trials by late 2025.

The coming years will likely see further integration of Phosphor-Jet Hybrid Printing with emerging printable electronics ecosystems. Companies like Konica Minolta are investing in R&D partnerships to combine hybrid phosphor-jet printing with flexible substrates, targeting automotive interior lighting and wearables. Moreover, SAMSUNG has filed patents and announced demonstration projects leveraging precise phosphor placement for ultra-high-resolution microLED TVs, projecting early commercialization toward 2027.

Investment trends reflect growing confidence in the technology’s scalability. According to 2025 statements by OSRAM, venture funding and joint ventures are accelerating, with major OEMs collaborating to co-develop bespoke phosphor formulations tuned for inkjet compatibility. The Seiko Epson Corporation has also expanded its inkjet printhead business to address demand for industrial-scale phosphor printing, anticipating double-digit annual growth in this segment through 2030.

Looking ahead, the sector’s vision for 2030 centers on full digitalization and customization of light-emitting devices. Hybrid printing processes are expected to underpin mass production of ultra-thin, energy-efficient display panels, smart lighting, and even biomedical sensors with patterned luminescent markers. Industry roadmaps released by NICHIA CORPORATION and SAMSUNG highlight ongoing research into multi-wavelength phosphor blends and high-speed printhead arrays, aiming to unlock entirely new form factors and application domains by the decade’s end.

Sources & References

- Kateeva

- Nichia Corporation

- OSRAM

- Seiko Instruments

- Hamamatsu Photonics

- Lumileds

- Canon Inc.

- Institute of Electrical and Electronics Engineers (IEEE)

- Mitsubishi Electric Research Laboratories

- Kyocera Corporation

- ams-OSRAM

- LG Display

- HELLA GmbH & Co. KGaA

- ASME

- Samsung Display

- Society for Information Display

- FUJIFILM Corporation

- Xaar plc