Graphene Photonics Engineering in 2025: How Revolutionary Materials Are Accelerating Optical Technologies and Reshaping the Future of Communications, Sensing, and Computing. Explore the Market Forces and Innovations Driving a New Era.

- Executive Summary: 2025 Market Outlook and Key Trends

- Graphene Photonics Fundamentals: Material Properties and Engineering Advances

- Current Market Size, Segmentation, and 2025–2030 Growth Forecasts

- Breakthrough Applications: Optical Communications, Sensing, and Imaging

- Key Players and Industry Ecosystem (e.g., Graphenea, IBM, Thales Group)

- Manufacturing Innovations and Scalability Challenges

- Regulatory Landscape and Industry Standards (IEEE, IEC)

- Investment, Funding, and Strategic Partnerships

- Competitive Analysis: Graphene vs. Alternative Photonic Materials

- Future Outlook: Disruptive Technologies and Long-Term Market Projections

- Sources & References

Executive Summary: 2025 Market Outlook and Key Trends

Graphene photonics engineering is poised for significant advancements and market expansion in 2025, driven by the material’s exceptional optical, electrical, and mechanical properties. As the demand for high-speed, energy-efficient photonic devices intensifies across telecommunications, sensing, and consumer electronics, graphene’s unique characteristics—such as broadband absorption, ultrafast carrier mobility, and tunable optical response—are enabling breakthroughs in device performance and miniaturization.

In 2025, the sector is witnessing increased commercialization efforts, with several industry leaders and innovative startups scaling up production and integration of graphene-based photonic components. Graphenea, a prominent graphene materials supplier, continues to expand its offerings of high-quality graphene films and wafers tailored for photonic and optoelectronic applications. Their collaborations with device manufacturers are accelerating the transition from laboratory prototypes to market-ready products. Similarly, Versarien is investing in advanced manufacturing processes to supply graphene materials for next-generation photonic devices, focusing on scalability and consistency.

Key application areas gaining traction in 2025 include graphene-based modulators, photodetectors, and integrated optical circuits. These components are critical for the evolution of 5G/6G networks, quantum communications, and LiDAR systems. For instance, AMS Technologies is actively involved in the development and distribution of graphene-enabled photonic devices, supporting European and global photonics supply chains. The company’s partnerships with research institutions and device manufacturers are fostering rapid prototyping and pilot-scale production.

The outlook for the next few years is marked by a convergence of material innovation, device engineering, and system-level integration. Industry consortia and public-private partnerships, such as those coordinated by Graphene Flagship, are playing a pivotal role in standardizing processes, validating device reliability, and accelerating technology transfer. These initiatives are expected to lower barriers to adoption and stimulate investment in graphene photonics infrastructure.

Looking ahead, the market is set to benefit from ongoing improvements in graphene synthesis, transfer, and patterning techniques, which are essential for high-yield, wafer-scale device fabrication. As end-user industries increasingly prioritize speed, bandwidth, and energy efficiency, graphene photonics engineering is positioned to become a cornerstone technology, with robust growth anticipated through 2025 and beyond.

Graphene Photonics Fundamentals: Material Properties and Engineering Advances

Graphene photonics engineering is rapidly advancing as researchers and industry leaders harness the unique optoelectronic properties of graphene for next-generation photonic devices. Graphene’s atomic thickness, high carrier mobility, broadband optical absorption, and ultrafast carrier dynamics make it a compelling material for applications ranging from optical modulators and photodetectors to integrated photonic circuits and quantum technologies.

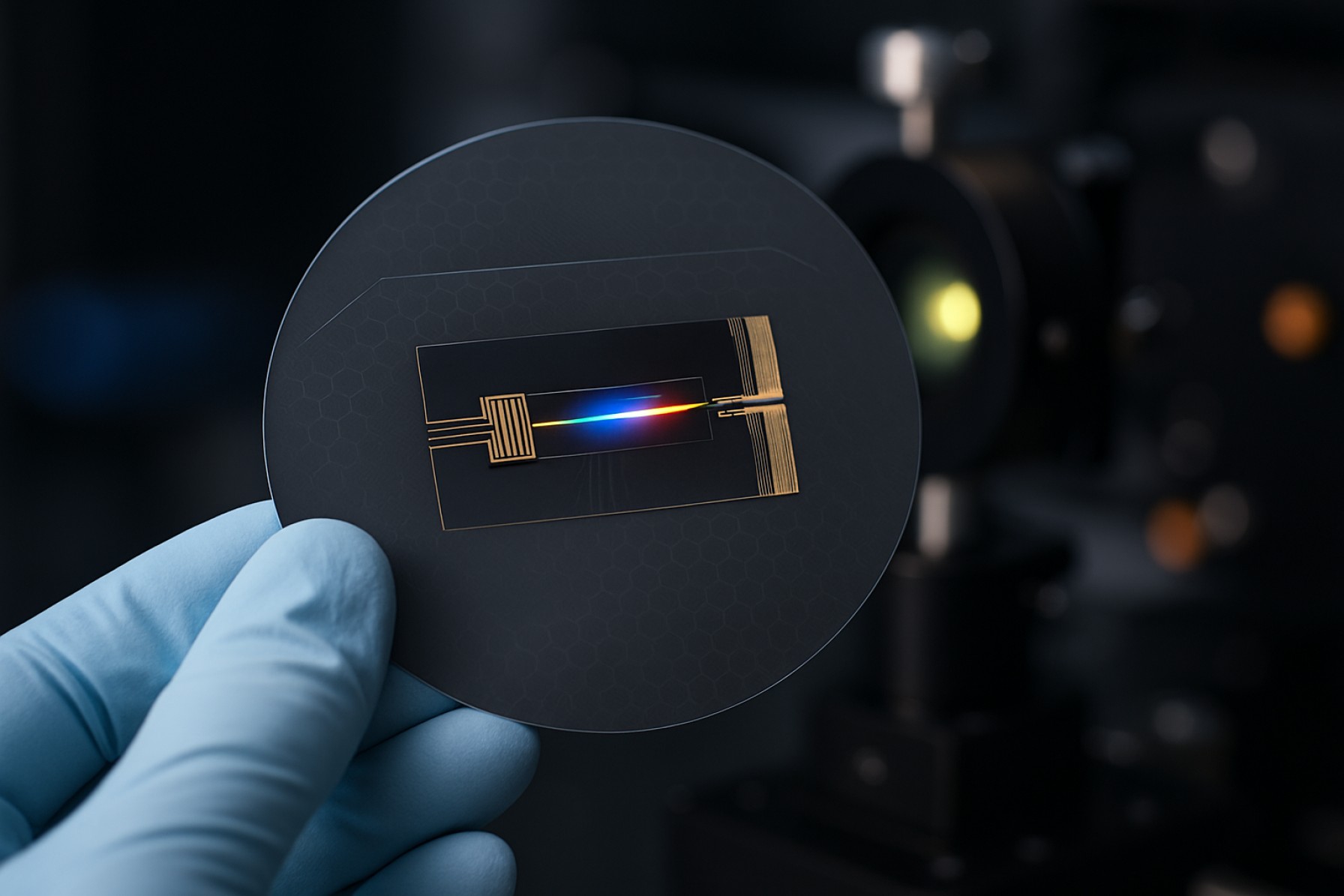

In 2025, the field is witnessing significant progress in the scalable synthesis and integration of high-quality graphene with silicon photonics platforms. Companies such as Graphenea and Graphene Platform Corporation are at the forefront, supplying wafer-scale graphene and developing transfer techniques compatible with CMOS processes. These advances are enabling the fabrication of graphene-based photonic devices with improved reproducibility and performance, addressing a key bottleneck for commercial deployment.

Recent engineering breakthroughs include the demonstration of graphene modulators operating at data rates exceeding 100 Gb/s, with energy efficiencies surpassing traditional semiconductor-based devices. For instance, AMS Technologies is collaborating with research institutions to develop graphene-integrated photonic components for telecom and datacom markets, targeting ultrafast, low-power optical interconnects. Additionally, Thales Group is exploring graphene’s nonlinear optical properties for applications in ultrafast lasers and frequency comb generation, leveraging graphene’s broadband response and high damage threshold.

On the detector front, graphene’s broadband absorption and fast carrier dynamics are being exploited to create photodetectors with high responsivity and bandwidth, suitable for applications in LiDAR, imaging, and quantum communications. Graphenea and Graphene Platform Corporation are supplying custom graphene films for prototype devices, while collaborative projects with European research consortia are pushing the performance envelope.

Looking ahead, the outlook for graphene photonics engineering in the next few years is promising. Industry roadmaps anticipate the integration of graphene-based modulators and detectors into commercial silicon photonics platforms by 2026–2027, driven by the demand for higher data rates and energy efficiency in data centers and 5G/6G networks. Furthermore, ongoing research into hybrid graphene–2D material heterostructures is expected to unlock new functionalities, such as tunable photonic devices and on-chip quantum light sources, positioning graphene as a cornerstone material in the evolution of photonic integrated circuits.

Current Market Size, Segmentation, and 2025–2030 Growth Forecasts

The global market for graphene photonics engineering is experiencing robust growth, driven by the material’s unique optical, electrical, and mechanical properties. As of 2025, the market is characterized by increasing adoption in telecommunications, optoelectronics, sensors, and advanced imaging systems. Graphene’s exceptional carrier mobility and broadband absorption make it a key enabler for next-generation photonic devices, including modulators, photodetectors, and integrated optical circuits.

Market segmentation reveals several core application areas. Telecommunications leads, with graphene-based modulators and photodetectors being integrated into high-speed optical networks to enhance data transmission rates and reduce energy consumption. Companies such as Nokia and Huawei are actively exploring graphene photonics for next-generation network infrastructure. In the consumer electronics sector, graphene is being incorporated into flexible displays and advanced camera sensors, with firms like Samsung Electronics and Sony Corporation investing in R&D for graphene-enabled optoelectronic components.

Another significant segment is the sensor market, where graphene’s high sensitivity and tunable optical properties are leveraged for environmental monitoring, medical diagnostics, and industrial automation. Companies such as AMETEK and HORIBA are developing graphene-based photonic sensors for real-time detection applications. Additionally, the integration of graphene with silicon photonics is a growing trend, with foundries and material suppliers like Graphenea and First Graphene providing high-quality graphene materials tailored for photonic device fabrication.

From 2025 to 2030, the graphene photonics engineering market is projected to expand at a double-digit compound annual growth rate (CAGR), fueled by ongoing advancements in material synthesis, device integration, and scalable manufacturing. The commercialization of graphene-based optical transceivers, modulators, and photodetectors is expected to accelerate, particularly as 5G/6G networks and quantum communication systems demand higher performance and lower latency. Strategic partnerships between technology developers, material suppliers, and end-users are anticipated to drive innovation and market penetration.

Looking ahead, the outlook for graphene photonics engineering remains highly positive. As manufacturing costs decrease and device performance improves, adoption is set to broaden across telecommunications, automotive LiDAR, medical imaging, and industrial sensing. The continued involvement of leading technology companies and material suppliers underscores the sector’s potential to reshape the photonics landscape over the next five years.

Breakthrough Applications: Optical Communications, Sensing, and Imaging

Graphene photonics engineering is rapidly advancing, with 2025 poised to be a pivotal year for breakthrough applications in optical communications, sensing, and imaging. The unique properties of graphene—such as its broadband optical absorption, ultrafast carrier dynamics, and high carrier mobility—are enabling the development of next-generation photonic devices that outperform traditional materials in speed, sensitivity, and integration potential.

In optical communications, graphene-based modulators and photodetectors are moving from laboratory prototypes to commercial deployment. Companies like Nokia and Huawei have demonstrated graphene-integrated photonic circuits capable of supporting data rates exceeding 100 Gb/s, with ongoing research targeting even higher speeds and lower power consumption. These advances are critical for meeting the bandwidth demands of 5G/6G networks and data centers. AMS Technologies, a European supplier, is actively developing graphene photonic components for telecom and datacom markets, focusing on integration with silicon photonics platforms for scalable manufacturing.

In the field of sensing, graphene’s high surface-to-volume ratio and tunable electronic properties are being harnessed for ultra-sensitive photodetectors and biosensors. Graphenea, a leading graphene materials producer, is collaborating with device manufacturers to supply high-quality graphene for photonic sensor applications, including environmental monitoring and medical diagnostics. These sensors are expected to achieve single-molecule detection sensitivity and real-time response, opening new possibilities in point-of-care diagnostics and industrial process control.

Imaging technologies are also benefiting from graphene’s exceptional optoelectronic characteristics. Empa, the Swiss Federal Laboratories for Materials Science and Technology, is advancing graphene-based infrared (IR) and terahertz (THz) imaging arrays, targeting applications in security screening, non-destructive testing, and biomedical imaging. The integration of graphene with CMOS-compatible processes is a key focus, aiming to enable high-resolution, low-cost imaging systems suitable for mass-market adoption.

Looking ahead, the outlook for graphene photonics engineering is robust. Industry roadmaps indicate that by 2027, graphene-enabled photonic devices will be increasingly integrated into commercial optical transceivers, sensor platforms, and imaging modules. The convergence of graphene with silicon photonics and flexible substrates is expected to drive further innovation, with major players such as Nokia, Huawei, and Graphenea at the forefront of this technological transformation.

Key Players and Industry Ecosystem (e.g., Graphenea, IBM, Thales Group)

The graphene photonics engineering sector in 2025 is characterized by a dynamic ecosystem of established technology leaders, specialized material suppliers, and innovative startups. These key players are driving advancements in graphene-based photonic devices, including modulators, detectors, and integrated circuits, with applications spanning telecommunications, sensing, and quantum technologies.

Among the most prominent companies is Graphenea, a Spain-based firm recognized for its high-quality graphene materials and devices. Graphenea supplies monolayer and multilayer graphene, as well as custom graphene-based components, to research institutions and industrial partners worldwide. The company has expanded its product portfolio to include graphene-on-wafer solutions, which are critical for scalable photonic integration. Their collaborations with photonics and semiconductor companies have positioned them as a foundational supplier in the ecosystem.

In the realm of integrated photonics, IBM continues to be a major innovator. IBM’s research division has demonstrated graphene-based photodetectors and modulators compatible with silicon photonics platforms, aiming to enhance data transmission speeds and energy efficiency in data centers and high-performance computing. IBM’s ongoing partnerships with academic and industrial consortia are expected to accelerate the commercialization of graphene photonic components over the next few years.

European defense and technology conglomerate Thales Group is leveraging graphene’s unique optoelectronic properties for advanced sensing and communication systems. Thales is actively involved in collaborative projects focused on integrating graphene into next-generation photonic circuits for secure communications and radar technologies. Their participation in European Union-funded initiatives underscores the strategic importance of graphene photonics for defense and aerospace applications.

Other notable contributors include AMS Technologies, which distributes graphene-based photonic components and supports system-level integration for industrial clients, and Oxford Instruments, a supplier of deposition and characterization equipment essential for graphene device fabrication. Startups such as Graphene Laboratories are also emerging, offering custom graphene solutions tailored for photonic and optoelectronic applications.

The industry ecosystem is further strengthened by collaborative research centers and standardization bodies, which facilitate technology transfer and interoperability. As the sector moves toward mass production and system-level integration, partnerships between material suppliers, device manufacturers, and end-users are expected to intensify, shaping the trajectory of graphene photonics engineering through 2025 and beyond.

Manufacturing Innovations and Scalability Challenges

The field of graphene photonics engineering is experiencing significant momentum in 2025, driven by both manufacturing innovations and persistent scalability challenges. Graphene’s exceptional optical and electronic properties—such as broadband absorption, ultrafast carrier dynamics, and high carrier mobility—make it a prime candidate for next-generation photonic devices, including modulators, detectors, and integrated circuits. However, the translation of laboratory-scale breakthroughs into industrial-scale production remains a central hurdle.

One of the most notable advances in recent years has been the refinement of chemical vapor deposition (CVD) techniques for producing large-area, high-quality graphene films. Companies like Graphenea and 2D Carbon Tech have reported progress in scaling up CVD processes, enabling the fabrication of wafer-scale graphene sheets with improved uniformity and fewer defects. These developments are crucial for integrating graphene into photonic integrated circuits (PICs) and other optoelectronic platforms, where material consistency directly impacts device performance.

Despite these advances, challenges persist in achieving reproducible, high-throughput manufacturing. The transfer of graphene from growth substrates to target photonic platforms often introduces contamination, wrinkles, or cracks, which can degrade optical performance. To address this, companies such as Graphene Platform Corporation are developing transfer-free growth methods and direct synthesis techniques, aiming to streamline integration and reduce yield losses.

Another area of innovation is the development of hybrid integration strategies, where graphene is combined with established photonic materials like silicon or indium phosphide. AMS Technologies and Graphene Flagship partners are actively exploring these approaches, leveraging graphene’s unique properties to enhance the speed and efficiency of modulators and photodetectors while maintaining compatibility with existing semiconductor fabrication infrastructure.

Looking ahead, the outlook for graphene photonics engineering hinges on overcoming these scalability barriers. Industry stakeholders are investing in automation, in-line quality control, and standardization of graphene materials to facilitate mass production. Collaborative efforts between material suppliers, device manufacturers, and research consortia are expected to accelerate the commercialization of graphene-based photonic components over the next few years. As these manufacturing innovations mature, the sector is poised to unlock new applications in telecommunications, sensing, and quantum technologies, marking a pivotal phase in the evolution of graphene-enabled photonics.

Regulatory Landscape and Industry Standards (IEEE, IEC)

The regulatory landscape and industry standards for graphene photonics engineering are rapidly evolving as the technology matures and moves toward broader commercialization. In 2025, the focus is on establishing robust frameworks to ensure safety, interoperability, and quality across the supply chain, with key roles played by international standards organizations such as the IEEE and the International Electrotechnical Commission (IEC).

The IEEE has been instrumental in developing standards for nanomaterials and photonic devices, with several working groups addressing the unique properties and integration challenges of graphene. The IEEE Photonics Society, in particular, is actively engaged in standardizing test methods, performance metrics, and reliability protocols for graphene-based photonic components, such as modulators, detectors, and waveguides. These efforts are crucial for ensuring that devices from different manufacturers can be benchmarked and integrated into larger photonic systems.

Similarly, the IEC has established technical committees, notably TC 113 (Nanotechnology for electrotechnical products and systems), which are working on standards for the characterization and measurement of graphene materials. The IEC’s ongoing work includes defining terminology, measurement techniques, and safety guidelines for the handling and integration of graphene in optoelectronic and photonic applications. These standards are expected to be increasingly referenced in procurement and qualification processes by 2025, as more companies transition from R&D to pilot and commercial production.

Industry consortia and alliances are also contributing to the regulatory framework. For example, the Graphene Flagship, a major European initiative, collaborates with standards bodies to align research outputs with emerging regulatory requirements. The Flagship’s Standardization Committee works closely with both IEEE and IEC to ensure that the unique aspects of graphene photonics—such as its two-dimensional nature and tunable optical properties—are adequately addressed in global standards.

Looking ahead, the next few years will likely see the publication of more comprehensive standards covering the full lifecycle of graphene photonic devices, from raw material synthesis to end-of-life disposal. Regulatory agencies in regions such as the EU, US, and Asia are expected to harmonize their approaches, reducing barriers to international trade and fostering a competitive, innovation-driven market. As graphene photonics moves toward mainstream adoption in telecommunications, sensing, and quantum technologies, adherence to these evolving standards will be a prerequisite for market entry and long-term success.

Investment, Funding, and Strategic Partnerships

Investment and strategic partnerships in graphene photonics engineering have accelerated markedly as the sector matures and commercial applications become increasingly viable. In 2025, the global push for advanced photonic devices—spanning telecommunications, sensing, and quantum technologies—has driven both established corporations and agile startups to intensify their focus on graphene-enabled solutions.

A notable trend is the influx of funding from major semiconductor and materials companies. Advanced Micro Devices (AMD) and Intel Corporation have both signaled interest in graphene photonics, particularly for next-generation data center interconnects and high-speed optical transceivers. These companies are exploring partnerships with graphene specialists to integrate atomically thin materials into silicon photonics platforms, aiming to overcome bandwidth and energy efficiency bottlenecks.

On the materials supply side, Versarien plc and Directa Plus S.p.A.—two of the world’s leading graphene producers—have expanded their R&D collaborations with photonics device manufacturers. These partnerships are focused on scaling up the production of high-purity graphene and developing tailored formulations for optoelectronic components, such as modulators and photodetectors.

In Europe, the Graphene Flagship continues to play a pivotal role in fostering cross-sector alliances. The initiative has catalyzed multi-million-euro consortia involving universities, research institutes, and industry players, with a strong emphasis on photonic integration and pilot manufacturing lines. The Flagship’s recent calls for industry-led projects have attracted new entrants from the telecom and quantum computing sectors, further diversifying the investment landscape.

Venture capital activity remains robust, with several rounds exceeding $10 million for startups specializing in graphene-based photonic chips and integrated circuits. Notably, companies such as Graphenea have secured strategic investments from both corporate venture arms and government innovation funds, enabling them to expand fabrication capabilities and accelerate product development cycles.

Looking ahead, the outlook for investment and partnerships in graphene photonics engineering is highly positive. As device prototypes transition to pilot-scale production and early commercial deployment, industry analysts anticipate a wave of joint ventures and licensing agreements. The convergence of graphene materials expertise with photonics engineering is expected to yield disruptive advances in optical communications, imaging, and quantum information processing over the next several years.

Competitive Analysis: Graphene vs. Alternative Photonic Materials

Graphene photonics engineering is at a pivotal stage in 2025, as the material’s unique optoelectronic properties are being rigorously compared to alternative photonic materials such as silicon, indium phosphide (InP), and transition metal dichalcogenides (TMDs). The competitive landscape is shaped by the drive for higher bandwidth, lower energy consumption, and miniaturization in photonic devices for telecommunications, sensing, and quantum technologies.

Graphene’s atomic thickness, broadband absorption, ultrafast carrier dynamics, and high carrier mobility position it as a strong contender for next-generation photonic components. In 2025, several companies are actively developing graphene-based modulators, photodetectors, and integrated circuits. Graphenea, a leading European graphene producer, supplies high-quality graphene for photonic device prototyping and collaborates with photonics foundries to integrate graphene into silicon photonics platforms. Versarien and First Graphene are also expanding their graphene offerings for optoelectronic applications, focusing on scalable production and device integration.

In contrast, silicon photonics remains the incumbent technology, with established supply chains and mature fabrication processes. Companies like Intel and AIM Photonics continue to push the limits of silicon-based modulators and detectors, but face intrinsic material limitations such as indirect bandgap and limited electro-optic response. Indium phosphide, used by firms like Coherent Corp. (formerly II-VI Incorporated), offers direct bandgap and high-speed operation, but at higher cost and with more complex integration challenges.

TMDs, such as MoS2 and WS2, are also gaining attention for their strong light-matter interaction and potential for flexible photonics. However, their large-scale synthesis and integration are less mature compared to graphene. In 2025, graphene’s compatibility with CMOS processes and its ability to enable broadband, ultrafast, and energy-efficient devices are key differentiators. For example, Graphene Flagship, a major European initiative, is supporting pilot lines and industrial collaborations to accelerate commercialization of graphene photonics.

Looking ahead, the next few years will likely see graphene photonics engineering move from laboratory demonstrations to pilot-scale manufacturing, with a focus on hybrid integration with silicon and InP platforms. The competitive edge will depend on advances in wafer-scale graphene growth, transfer techniques, and device reliability. As industry standards emerge and costs decrease, graphene is poised to capture a significant share of the photonic components market, particularly in high-speed data communications and advanced sensing applications.

Future Outlook: Disruptive Technologies and Long-Term Market Projections

Graphene photonics engineering is poised to be a transformative force in optoelectronics, telecommunications, and sensing technologies as the industry moves through 2025 and into the latter part of the decade. The unique properties of graphene—such as its exceptional carrier mobility, broadband optical absorption, and ultrafast response times—are driving a wave of innovation in photonic devices, including modulators, photodetectors, and integrated optical circuits.

In 2025, several leading companies and research organizations are accelerating the commercialization of graphene-based photonic components. Graphenea, a prominent graphene materials supplier, continues to expand its offerings of high-quality graphene films and wafers tailored for photonic applications, supporting both prototyping and volume manufacturing. Versarien is also investing in the development of graphene-enhanced optoelectronic devices, targeting sectors such as data communications and advanced imaging.

A key area of focus is the integration of graphene with silicon photonics platforms, which promises to overcome bandwidth and energy efficiency limitations of conventional materials. Companies like AMS Technologies are collaborating with research institutes to develop hybrid photonic integrated circuits (PICs) that leverage graphene’s tunability and speed. These efforts are expected to yield commercial products for high-speed optical interconnects and next-generation LiDAR systems by 2026–2027.

In the telecommunications sector, graphene-based modulators and photodetectors are being developed to support the exponential growth in data traffic and the rollout of 6G networks. Thales Group is actively involved in European initiatives to demonstrate graphene-enabled photonic devices for ultra-fast, energy-efficient data transmission. Early prototypes have shown modulation speeds exceeding 100 GHz, with the potential for further improvements as fabrication techniques mature.

Looking ahead, the convergence of graphene photonics with quantum technologies is anticipated to unlock new functionalities, such as single-photon sources and detectors for quantum communication. Industry roadmaps suggest that by 2028–2030, graphene photonics could underpin a new class of integrated quantum photonic circuits, with Graphenea and other material suppliers playing a pivotal role in scaling up production and ensuring device reliability.

Overall, the outlook for graphene photonics engineering is highly promising, with disruptive technologies on the horizon that could reshape multiple industries. Continued investment from established players and the emergence of specialized startups are expected to accelerate the transition from laboratory demonstrations to widespread commercial adoption over the next five years.

Sources & References

- Versarien

- AMS Technologies

- Graphene Flagship

- Graphene Platform Corporation

- AMS Technologies

- Thales Group

- Nokia

- Huawei

- AMETEK

- HORIBA

- First Graphene

- Empa

- IBM

- Thales Group

- Oxford Instruments

- Graphene Platform Corporation

- IEEE

- Directa Plus S.p.A.

- Versarien

- First Graphene