Imidazolium-Based Ionic Liquid Electrolyte Manufacturing in 2025: Unleashing Next-Gen Battery Performance and Market Expansion. Explore the Breakthroughs, Key Players, and Forecasts Shaping the Industry’s Future.

- Executive Summary: 2025 Market Overview and Key Insights

- Technology Landscape: Imidazolium-Based Ionic Liquid Electrolytes Explained

- Manufacturing Processes and Innovations in 2025

- Key Players and Strategic Partnerships (e.g., solvay.com, basf.com, merckgroup.com)

- Market Size, Segmentation, and 2025–2030 Growth Forecasts (CAGR: 12–15%)

- Application Trends: Batteries, Supercapacitors, and Beyond

- Regulatory Environment and Industry Standards (e.g., ieee.org, batteryassociation.org)

- Supply Chain Dynamics and Raw Material Sourcing

- Competitive Analysis and Barriers to Entry

- Future Outlook: Disruptive Technologies and Long-Term Opportunities

- Sources & References

Executive Summary: 2025 Market Overview and Key Insights

The imidazolium-based ionic liquid electrolyte manufacturing sector is poised for significant growth in 2025, driven by accelerating demand for advanced energy storage solutions and the ongoing transition to sustainable technologies. Imidazolium ionic liquids, known for their high electrochemical stability, low volatility, and wide electrochemical windows, are increasingly favored in next-generation lithium-ion and sodium-ion batteries, supercapacitors, and other electrochemical devices.

In 2025, the market landscape is characterized by a combination of established chemical manufacturers and emerging specialty suppliers scaling up production capacities. Key players such as BASF and Solvay continue to invest in research and process optimization to improve the purity, yield, and cost-effectiveness of imidazolium-based ionic liquids. These companies leverage their extensive chemical synthesis expertise and global supply chains to meet the growing needs of battery and electronics manufacturers.

Specialty chemical firms, including Merck KGaA (operating as MilliporeSigma in North America) and IoLiTec Ionic Liquids Technologies, are expanding their portfolios of high-purity imidazolium salts tailored for specific electrochemical applications. These suppliers are responding to increasing requests for custom formulations and scalable production, particularly from automotive and grid storage sectors seeking to enhance battery safety and performance.

Manufacturing advancements in 2025 focus on greener synthesis routes, solvent-free processes, and recycling of ionic liquids to address environmental and regulatory pressures. Companies are also investing in automation and digitalization to ensure consistent product quality and traceability. For example, Solvay has announced initiatives to integrate digital process controls and sustainability metrics into its ionic liquid production lines.

Geographically, Asia-Pacific remains a major hub for both production and consumption, with Chinese and Japanese manufacturers ramping up output to supply domestic battery industries. European and North American firms are also increasing capacity, often through partnerships or licensing agreements, to secure local supply chains and reduce reliance on imports.

Looking ahead, the outlook for imidazolium-based ionic liquid electrolyte manufacturing is robust. The sector is expected to benefit from continued growth in electric vehicles, stationary energy storage, and flexible electronics. Ongoing collaboration between chemical producers, battery manufacturers, and research institutions will likely accelerate the commercialization of new formulations and manufacturing techniques, positioning imidazolium-based electrolytes as a cornerstone of advanced energy storage technologies in the coming years.

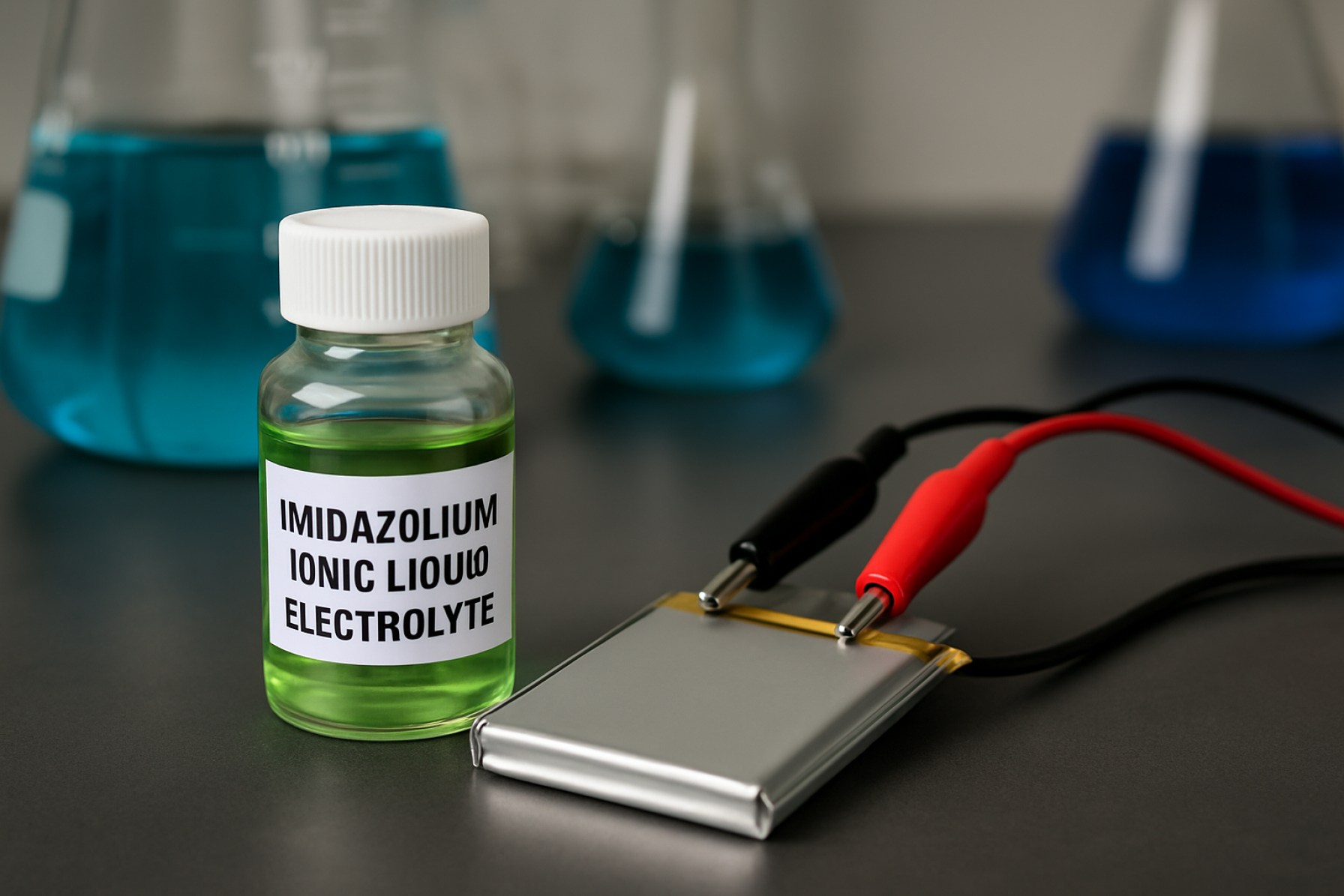

Technology Landscape: Imidazolium-Based Ionic Liquid Electrolytes Explained

Imidazolium-based ionic liquid electrolytes have emerged as a promising class of materials for next-generation batteries, supercapacitors, and other electrochemical devices. Their unique properties—such as high ionic conductivity, wide electrochemical windows, and non-flammability—have driven significant interest in their commercial-scale manufacturing. As of 2025, the technology landscape for imidazolium-based ionic liquid electrolyte production is characterized by both established chemical manufacturers and specialized startups scaling up synthesis, purification, and formulation processes.

The core manufacturing process involves the quaternization of imidazole derivatives, typically with alkyl halides, followed by anion exchange to yield the desired ionic liquid. Key process parameters include the choice of alkyl chain length, purity of starting materials, and the efficiency of anion metathesis, all of which impact the final electrolyte’s performance and cost. Recent years have seen advances in continuous-flow synthesis and solvent-free methods, which reduce waste and improve scalability.

Several major chemical companies are actively involved in the production and supply of imidazolium-based ionic liquids. BASF and Solvay are among the global leaders, leveraging their expertise in specialty chemicals to offer a range of ionic liquids for industrial and research applications. Merck KGaA (also known as MilliporeSigma in the US and Canada) supplies high-purity imidazolium salts tailored for battery and supercapacitor electrolytes. IoLiTec Ionic Liquids Technologies, a German-based specialist, focuses exclusively on ionic liquid development and has expanded its portfolio to include custom imidazolium-based formulations for energy storage.

On the supply chain side, the availability of high-purity precursors and scalable anion exchange technologies remains a focal point. Companies are investing in process intensification and automation to meet the growing demand from the battery sector, particularly for lithium-ion and emerging sodium-ion chemistries. Environmental and regulatory considerations are also shaping manufacturing practices, with a shift toward greener synthesis routes and closed-loop recycling of byproducts.

Looking ahead to the next few years, the outlook for imidazolium-based ionic liquid electrolyte manufacturing is robust. As battery manufacturers seek safer and higher-performance alternatives to conventional electrolytes, demand is expected to rise. Ongoing collaborations between chemical producers and battery OEMs are likely to accelerate the commercialization of new formulations, with a focus on cost reduction, scalability, and environmental sustainability. The sector is poised for further innovation, driven by both established players and agile newcomers.

Manufacturing Processes and Innovations in 2025

The manufacturing landscape for imidazolium-based ionic liquid electrolytes is undergoing significant transformation in 2025, driven by the demand for safer, high-performance electrolytes in advanced batteries and electrochemical devices. Imidazolium cations, such as 1-ethyl-3-methylimidazolium (EMIM) and 1-butyl-3-methylimidazolium (BMIM), are favored for their thermal stability, wide electrochemical windows, and tunable physicochemical properties. The synthesis of these ionic liquids typically involves alkylation of imidazole, followed by anion exchange to introduce functional anions like bis(trifluoromethanesulfonyl)imide (TFSI) or hexafluorophosphate (PF6–).

In 2025, manufacturers are increasingly adopting continuous flow synthesis and modular production units to improve scalability and reduce batch-to-batch variability. This shift is particularly evident among leading specialty chemical producers such as Solvay and BASF, both of which have expanded their ionic liquid portfolios and invested in process intensification. These companies leverage advanced purification techniques, including membrane separations and high-vacuum distillation, to achieve the ultra-high purity required for battery-grade electrolytes.

A notable innovation is the integration of green chemistry principles, with manufacturers like Merck KGaA (operating as MilliporeSigma in the US and Canada) focusing on solvent-free synthesis routes and the use of recyclable catalysts. This not only reduces environmental impact but also lowers production costs and aligns with tightening regulatory standards in the EU and Asia. Additionally, automation and digitalization are being implemented to monitor reaction parameters in real time, ensuring consistent product quality and traceability.

Supply chain resilience is another area of focus. Companies such as IoLiTec Ionic Liquids Technologies are expanding their manufacturing footprints in Europe and Asia to mitigate geopolitical risks and meet the growing demand from electric vehicle and grid storage sectors. Strategic partnerships between electrolyte manufacturers and battery cell producers are also becoming more common, facilitating co-development of tailored formulations and accelerating time-to-market.

Looking ahead, the outlook for imidazolium-based ionic liquid electrolyte manufacturing is robust. With ongoing investments in process innovation, sustainability, and regional production capacity, the sector is well-positioned to support the next generation of high-energy, safe, and durable batteries. As regulatory and market pressures intensify, further advancements in synthesis efficiency and supply chain integration are expected to define the competitive landscape through the remainder of the decade.

Key Players and Strategic Partnerships (e.g., solvay.com, basf.com, merckgroup.com)

The landscape of imidazolium-based ionic liquid electrolyte manufacturing in 2025 is shaped by a select group of global chemical and materials companies, each leveraging their expertise in advanced materials, specialty chemicals, and electrochemistry. These key players are not only scaling up production but also forming strategic partnerships to accelerate innovation and commercialization in energy storage, particularly for next-generation batteries and supercapacitors.

- Solvay S.A. remains a prominent force in the ionic liquids sector, with a dedicated portfolio of advanced materials and specialty chemicals. The company’s ongoing investments in research and development have enabled the optimization of imidazolium-based ionic liquids for use as electrolytes in lithium-ion and emerging sodium-ion batteries. Solvay’s collaborations with battery manufacturers and automotive OEMs are expected to intensify through 2025, focusing on improving electrolyte stability and safety for high-performance applications (Solvay S.A.).

- BASF SE continues to expand its footprint in the ionic liquid market, leveraging its global manufacturing capabilities and deep expertise in chemical synthesis. BASF’s strategic alliances with academic institutions and technology startups are aimed at developing scalable, cost-effective production methods for imidazolium-based electrolytes. The company is also exploring joint ventures with battery cell manufacturers to integrate these electrolytes into commercial energy storage systems (BASF SE).

- Merck KGaA (operating as MilliporeSigma in North America) is recognized for its high-purity ionic liquids, including a range of imidazolium derivatives tailored for electrochemical applications. Merck’s focus on quality control and customization has positioned it as a preferred supplier for research institutions and pilot-scale battery developers. The company is actively engaging in partnerships with electric vehicle and grid storage stakeholders to co-develop next-generation electrolyte formulations (Merck KGaA).

- Evonik Industries AG is another significant player, with a strong emphasis on specialty chemicals and advanced materials. Evonik’s research initiatives in ionic liquids are supported by collaborations with European battery consortia and materials science institutes, aiming to enhance the conductivity and thermal stability of imidazolium-based electrolytes for commercial battery platforms (Evonik Industries AG).

Looking ahead, the next few years are expected to see deeper integration between these chemical manufacturers and downstream battery producers, with joint development agreements and supply contracts driving the commercialization of imidazolium-based electrolytes. The sector’s outlook is further bolstered by increasing regulatory and market demand for safer, more efficient energy storage solutions, positioning these key players at the forefront of innovation and scale-up in the field.

Market Size, Segmentation, and 2025–2030 Growth Forecasts (CAGR: 12–15%)

The global market for imidazolium-based ionic liquid electrolytes is poised for robust expansion between 2025 and 2030, with compound annual growth rate (CAGR) projections ranging from 12% to 15%. This growth is driven by the increasing adoption of advanced energy storage systems, particularly lithium-ion and next-generation batteries, where imidazolium-based ionic liquids offer superior thermal stability, non-flammability, and wide electrochemical windows compared to conventional organic electrolytes.

Market segmentation reveals that the largest share of demand comes from the battery manufacturing sector, especially for electric vehicles (EVs) and grid-scale energy storage. The Asia-Pacific region, led by China, Japan, and South Korea, dominates both production and consumption, owing to the presence of major battery manufacturers and a strong push for electrification. Europe and North America are also witnessing accelerated uptake, driven by regulatory mandates for clean energy and the localization of battery supply chains.

Key manufacturers and suppliers of imidazolium-based ionic liquids include Solvay, a global leader in specialty chemicals, and Merck KGaA (operating as MilliporeSigma in the US and Canada), which offers a broad portfolio of ionic liquids for research and industrial applications. IoLiTec Ionic Liquids Technologies specializes in the custom synthesis and scale-up of imidazolium-based electrolytes, serving both academic and industrial clients. Strem Chemicals (now part of Ascensus Specialties) and Sigma-Aldrich (a subsidiary of Merck KGaA) are also prominent suppliers, providing high-purity ionic liquids for battery R&D and pilot-scale manufacturing.

From a segmentation perspective, the market is categorized by application (batteries, supercapacitors, electrochemical devices), end-user (automotive, grid storage, consumer electronics), and purity/grade (research, industrial, battery-grade). Battery-grade imidazolium-based electrolytes are expected to see the fastest growth, with demand closely tied to the scaling of gigafactories and the commercialization of solid-state and high-voltage battery chemistries.

Looking ahead, the market outlook remains highly favorable. Ongoing investments in battery innovation, coupled with tightening safety and performance standards, are expected to accelerate the shift toward advanced electrolytes. Strategic partnerships between chemical producers and battery OEMs are likely to shape supply dynamics, while regional initiatives to secure critical materials and reduce environmental impact will further stimulate market expansion through 2030.

Application Trends: Batteries, Supercapacitors, and Beyond

Imidazolium-based ionic liquid electrolytes are increasingly recognized for their pivotal role in advancing next-generation energy storage devices, particularly in batteries and supercapacitors. As of 2025, the manufacturing landscape for these electrolytes is shaped by both established chemical producers and emerging specialty suppliers, responding to the growing demand for safer, high-performance alternatives to conventional organic electrolytes.

In lithium-ion batteries, imidazolium-based ionic liquids are valued for their wide electrochemical windows, non-flammability, and thermal stability. These properties address critical safety and longevity concerns in electric vehicles (EVs) and grid storage. Major chemical manufacturers such as BASF and Solvay have expanded their portfolios to include ionic liquid intermediates and precursors, supporting downstream electrolyte formulators. INEOS and Evonik Industries are also active in supplying high-purity imidazole derivatives and related chemicals, which are essential for scalable, reproducible electrolyte production.

Supercapacitor manufacturers are increasingly adopting imidazolium-based electrolytes to achieve higher operating voltages and improved cycle life. Companies such as CAP-XX and Maxwell Technologies (now part of Tesla) are exploring these materials for next-generation devices, aiming to bridge the gap between energy and power density. The compatibility of imidazolium ionic liquids with carbon-based electrodes and their low volatility make them attractive for high-reliability applications in transportation and industrial sectors.

Beyond batteries and supercapacitors, imidazolium-based ionic liquids are being trialed in emerging fields such as redox flow batteries, solid-state electrolytes, and hybrid capacitive systems. The modularity of imidazolium cations allows for fine-tuning of viscosity, conductivity, and electrochemical stability, enabling tailored solutions for niche applications. Specialty chemical firms like Merck KGaA and Strem Chemicals supply research-grade and industrial-scale ionic liquids, supporting innovation in academic and commercial R&D.

Looking ahead, the outlook for imidazolium-based ionic liquid electrolyte manufacturing is robust. As regulatory pressures mount to phase out hazardous solvents and as battery manufacturers seek to enhance safety and performance, demand for these advanced electrolytes is expected to accelerate. Strategic partnerships between chemical suppliers and device manufacturers are likely to intensify, with a focus on cost reduction, process scalability, and lifecycle sustainability. The next few years will see further integration of imidazolium-based electrolytes into mainstream energy storage technologies, driven by both performance imperatives and evolving regulatory standards.

Regulatory Environment and Industry Standards (e.g., ieee.org, batteryassociation.org)

The regulatory environment and industry standards for imidazolium-based ionic liquid electrolyte manufacturing are evolving rapidly as the global battery and advanced materials sectors seek safer, more efficient, and environmentally responsible solutions. In 2025, the focus is on harmonizing safety, purity, and performance requirements, particularly as these electrolytes gain traction in lithium-ion and next-generation battery chemistries.

Key international standards bodies, such as the IEEE, are actively developing and updating protocols for the testing and characterization of ionic liquid electrolytes. These standards address critical parameters including ionic conductivity, electrochemical stability window, viscosity, and compatibility with electrode materials. The IEEE has ongoing working groups dedicated to battery safety and performance, which increasingly reference ionic liquid systems due to their non-flammable nature and potential to enhance battery safety profiles.

Industry associations, notably the Battery Association, are collaborating with manufacturers and research institutions to establish best practices for the synthesis, handling, and quality control of imidazolium-based ionic liquids. These efforts are crucial for ensuring batch-to-batch consistency and minimizing impurities, which can significantly impact battery performance and longevity. The Battery Association also provides guidance on environmental, health, and safety (EHS) protocols, reflecting growing regulatory scrutiny over the lifecycle impacts of advanced electrolyte materials.

On the regulatory front, agencies in the European Union, United States, and Asia-Pacific are updating chemical registration and safety assessment frameworks to address the unique properties of ionic liquids. The European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) are expected to issue new guidance on the registration, evaluation, and safe use of imidazolium-based compounds, particularly regarding their biodegradability and potential toxicity. Manufacturers such as Solvay and BASF, both active in the development and supply of ionic liquids, are closely monitoring these regulatory developments to ensure compliance and maintain market access.

Looking ahead, the next few years will likely see the introduction of more stringent purity and safety standards, as well as increased emphasis on sustainable manufacturing practices. Industry stakeholders are expected to intensify collaboration with standards organizations and regulatory bodies to facilitate the responsible commercialization of imidazolium-based ionic liquid electrolytes, supporting their integration into mainstream battery technologies.

Supply Chain Dynamics and Raw Material Sourcing

The supply chain dynamics and raw material sourcing for imidazolium-based ionic liquid electrolytes are undergoing significant evolution as the global demand for advanced battery technologies and electrochemical devices accelerates into 2025 and beyond. Imidazolium-based ionic liquids, prized for their high ionic conductivity, thermal stability, and electrochemical window, are increasingly sought after for use in lithium-ion and next-generation batteries, supercapacitors, and specialty electrochemical applications.

The core raw materials for imidazolium-based ionic liquids include imidazole derivatives, alkyl halides, and various anion sources (such as tetrafluoroborate, hexafluorophosphate, and bis(trifluoromethanesulfonyl)imide). The global supply of these precursors is closely tied to the chemical manufacturing sectors in China, Europe, and the United States. In 2025, China remains the dominant supplier of both imidazole and alkyl halide intermediates, leveraging its extensive chemical production infrastructure and cost advantages. Major chemical producers such as Sinopec Group and PetroChina play a pivotal role in the upstream supply of these chemicals, while specialty chemical companies in Europe, including BASF and Evonik Industries, are key suppliers of high-purity anion sources and advanced intermediates.

The manufacturing of imidazolium-based ionic liquids is highly sensitive to the purity and consistency of raw materials, as impurities can significantly impact electrolyte performance. As a result, there is a growing trend toward vertical integration and long-term supply agreements between electrolyte manufacturers and chemical suppliers. Companies such as Solvay and Merck KGaA (operating as MilliporeSigma in the US) have expanded their portfolios to include high-purity ionic liquid precursors and finished electrolytes, ensuring greater control over quality and supply chain resilience.

Geopolitical factors and environmental regulations are also shaping the supply chain landscape. The European Union’s REACH regulations and China’s tightening of chemical safety standards are prompting manufacturers to invest in greener synthesis routes and more robust traceability systems. This is expected to drive further consolidation among suppliers and encourage the adoption of sustainable sourcing practices.

Looking ahead, the outlook for imidazolium-based ionic liquid electrolyte manufacturing is one of cautious optimism. While supply chain vulnerabilities—such as potential disruptions in China or regulatory shifts in Europe—remain, the increasing involvement of global chemical majors and the push for local production in North America and Europe are expected to enhance supply security. Strategic partnerships and investments in raw material purification technologies will likely define the competitive landscape through the next several years.

Competitive Analysis and Barriers to Entry

The competitive landscape for imidazolium-based ionic liquid electrolyte manufacturing in 2025 is characterized by a small but growing cohort of specialized chemical producers, established materials companies, and a handful of innovative start-ups. The sector is driven by increasing demand for advanced electrolytes in next-generation batteries, supercapacitors, and other electrochemical devices, with a particular focus on safety, thermal stability, and electrochemical performance.

Key players in this space include Solvay, a global leader in specialty chemicals, which has invested in ionic liquid research and production capabilities, and BASF, which leverages its extensive chemical synthesis infrastructure to supply high-purity ionic liquids for energy storage and industrial applications. Merck KGaA (also known as MilliporeSigma in the US and Canada) is another significant supplier, offering a range of imidazolium-based ionic liquids for research and commercial use. In Asia, Tokyo Chemical Industry Co., Ltd. (TCI) and BASF (China) are notable for their regional manufacturing and distribution networks.

Despite the growing interest, barriers to entry remain substantial. The synthesis of high-purity imidazolium-based ionic liquids requires advanced chemical engineering expertise, stringent process controls, and access to high-quality raw materials. Intellectual property (IP) protection is a significant factor, with established companies holding key patents on synthesis routes, purification methods, and electrolyte formulations. For example, Solvay and BASF have both filed patents related to ionic liquid production and application in electrochemical devices.

Regulatory compliance and environmental considerations also present challenges. The manufacturing process must adhere to strict safety and environmental standards, particularly regarding the handling and disposal of halogenated precursors and byproducts. Companies with established compliance frameworks, such as Solvay and BASF, are better positioned to navigate these requirements.

Looking ahead, the competitive environment is expected to intensify as demand for safer, high-performance electrolytes grows in the battery and energy storage sectors. However, new entrants will need to overcome significant technical, regulatory, and capital barriers to achieve commercial-scale production and market acceptance. Strategic partnerships, licensing agreements, and investment in proprietary process technologies are likely to shape the competitive dynamics over the next several years.

Future Outlook: Disruptive Technologies and Long-Term Opportunities

The future outlook for imidazolium-based ionic liquid (IL) electrolyte manufacturing is shaped by a convergence of technological innovation, regulatory drivers, and the evolving needs of advanced energy storage and electrochemical devices. As of 2025, the sector is witnessing a transition from laboratory-scale synthesis to scalable, industrial production, with several key players and disruptive technologies poised to redefine the landscape over the next few years.

A primary driver is the demand for safer, high-performance electrolytes in lithium-ion and next-generation batteries. Imidazolium-based ILs, known for their non-flammability, wide electrochemical windows, and thermal stability, are increasingly targeted for use in electric vehicles (EVs), grid storage, and specialty applications such as supercapacitors and solid-state batteries. Companies like Solvay and BASF have established themselves as major chemical suppliers with capabilities in IL synthesis, leveraging their expertise in specialty chemicals to scale up production and ensure consistent quality.

Disruptive manufacturing technologies are emerging, including continuous flow synthesis and modular production units, which promise to reduce costs and improve the environmental footprint of IL manufacturing. These methods enable precise control over reaction conditions, minimize waste, and facilitate rapid adaptation to new IL formulations. Merck KGaA (operating as MilliporeSigma in North America) is actively developing advanced synthesis and purification processes, aiming to supply high-purity ILs for both research and industrial customers.

Another significant trend is the integration of green chemistry principles, with manufacturers exploring bio-based feedstocks and solvent-free processes to address sustainability concerns. This aligns with regulatory pressures in Europe and Asia, where environmental standards for chemical manufacturing are tightening. Companies such as INEOS and Evonik Industries are investing in R&D to develop more sustainable IL production pathways, anticipating future market and compliance requirements.

Looking ahead, the next few years are expected to see increased collaboration between IL manufacturers, battery OEMs, and research institutions to accelerate the commercialization of imidazolium-based electrolytes. Strategic partnerships and joint ventures will likely emerge, focusing on the co-development of tailored ILs for specific battery chemistries and performance targets. As manufacturing scales and costs decline, imidazolium-based ILs are positioned to capture a growing share of the electrolyte market, particularly in high-value, safety-critical applications.

In summary, the outlook for imidazolium-based ionic liquid electrolyte manufacturing is marked by rapid technological progress, a shift toward sustainable production, and expanding market opportunities driven by the electrification of transport and the rise of advanced energy storage systems.

Sources & References

- BASF

- Evonik Industries AG

- Strem Chemicals

- Sigma-Aldrich

- INEOS

- CAP-XX

- Maxwell Technologies

- IEEE

- Tokyo Chemical Industry Co., Ltd. (TCI)